Your NRI Financial Journey Starts Here!

The American Dream is the belief that anyone, regardless of where they were born or what class they were born into, can attain their own version of success in a society where upward mobility is possible for everyone. The American Dream is achieved through sacrifice, risk-taking, and hard work, rather than by chance.

Non-Residents Indian (NRI) diaspora believes that everyone can achieve success, better life and happiness in the USA. Most of the NRI community is first generation immigrants unlike most other communities. We do not know what we don’t know. This website is an effort to bring awareness to Indian community with most important things to achieve American Dream!

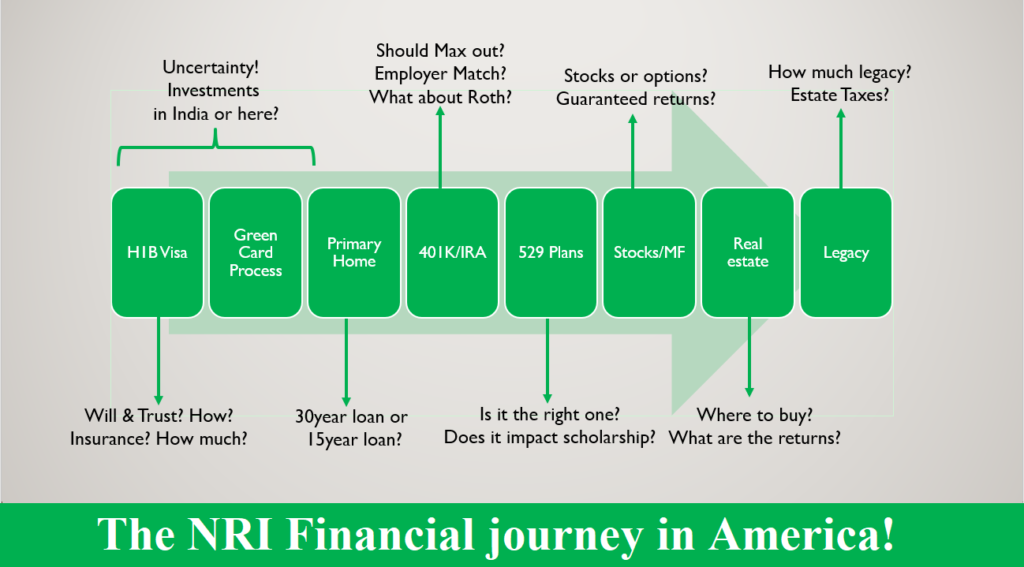

When we come here to America with American dreams, we do not have a long term vision. Most of the first generation immigrant NRIs come to America with a goal- Let me make some money and go back. But the life style, being resident of America change the perception overtime and most of the NRIs make America as their home. But the initial years of confusion, uncertainity does not allow NRIs to plan their financial future. Another biggest thing is not knowing what they are missing out. Blind spots! Many H1B immigrants do not even contribute to 401K even to get free employer matching. There are many needs and goals that evolve as they start living here and making America as their home! Sign-up for upcoming FREE webinar to learn the blind spots and take action to correct them!

Client Reviews

Our clients praise us for our expert knowledge, passionate service, unbiased advice and comprehensive solutions. Here are what just a few of them had to say:

The Numbers

Latest Posts & Articles

Stay up to date on the latest information in financial education with NRIPath’s very own NRI Pulse Blog! We will cover various topics like College Planning for NRI kids, WIll & Trust for NRIs, Insurance for NRIs, Tax saving for NRIs, Investment opportunities for NRIs and many more! Subscribe to our news letter if you would like to get notified!

NRI’s preferred insurance plan? Term vs Permanent?

Although term life insurance is already less expensive than permanent life insurance policies, Term life has it own place in financial planning. Whether term life or permanent life is better depends on your situation.

The difference between Will & Trust for NRIs

A will is a legally bound document that details your wishes for how you want all of your physical, intellectual, and digital assets to be handled after you die. Passing wealth from one spouse to the other is generally not an issue. The United States Estate and Gift Tax Law allows the passing of wealth to a surviving spouse without incurring gift or estate tax liabilities with the unlimited marital deduction provision. The wealth transfer to kids, grandkids is more involved.

2020 Tax Brackets

The IRS used to use the Consumer Price Index (CPI) to calculate the past year’s inflation. However, with the Tax Cuts and Jobs Act of 2017, the IRS will now use the Chained Consumer Price Index (C-CPI) to adjust income thresholds, deduction amounts, and credit values accordingly.

Retirement strategies for NRIs

Planning for retirement at an early age is the best way to go for a peaceful retirement. Retirement planning is not just saving money in a bank account or in 401K, you identify your goals and then figure out how to save and invest to get there. Take a step back and have a big picture before getting into formulas and calculations.

Have Any Questions?

Most of us are first generation immigrants and we have not got the knowledge or guidance from our parents or grand parents on how to live in this country, We learn as we go but most of the times, it is too late in the game to make adjustments to meet our financial goals. A solid financial guidance on what are all the areas to focus and identify blind spots will help NRIs to achieve Financial Freedom! Contact us for 60 minute FREE 1-1 consultation with our experienced advisors.