Tax brackets are one of the most misunderstood yet foundational concepts in U.S. financial planning. Whether you’re earning a salary, running a business, or managing cross-border income, understanding how your income is taxed is essential, especially for NRIs balancing U.S. obligations with global assets.

What Are Tax Brackets?

The U.S. tax system is progressive, meaning your income is taxed in layers. Each layer corresponds to a specific tax rate. As your income increases, only the portion that falls into the next bracket is taxed at the higher rate—not your entire income.

Common Misconception: Many people believe that entering a higher bracket means all their income is taxed at that rate. In reality, only the income within that bracket is taxed more.

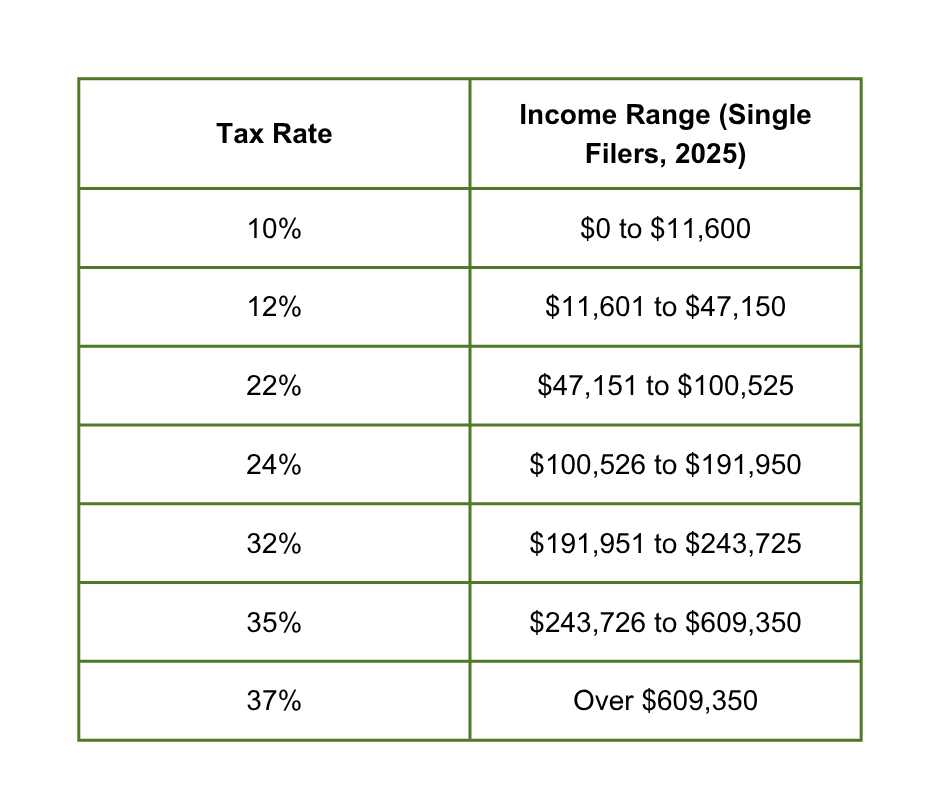

The 2025 Federal Tax Brackets (Single Filers)

Here are the official brackets for 2025:

A Simple Example

Suppose your taxable income is $50,000 in 2025. Here’s how your federal tax liability is calculated:

- First $11,600 taxed at 10% = $1,160.00

- Next $35,550 taxed at 12% = $4,266.00

- Remaining $2,850 taxed at 22% = $627.00 Total Tax = $6,053 Effective Tax Rate = 12.1%

Even though you reached the 22% bracket, most of your income was taxed at lower rates. This layered structure is key to smart income planning and maximizing deductions.

Why This Matters on Your Journey

Knowing your tax bracket gives you clarity and control. It helps you:

- Plan for raises or side income

- Use deductions and retirement accounts wisely

- Avoid surprises at tax time

In short, it keeps more money in your pocket and your financial journey on track.

The Next Chapter: From Brackets to Buckets

If tax brackets tell you how your income is taxed today, tax buckets show you how your assets will be taxed tomorrow. Buckets help you organize your money into categories—taxable, tax deferred, and tax free, so you can control how much tax you pay in retirement.

This next step is where strategy meets structure. We’ll explore how to use tax buckets to accelerate your journey toward financial freedom.